Spotify, the world's leading music streaming service, has been facing questions about its long-term viability and profitability. Despite its massive user base and dominance in the industry, concerns have been raised about the company's ability to sustain its business model and achieve consistent profitability.

Let's explore Spotify's recent financial performance, the challenges it faces, and assess the likelihood of the company going out of business, drawing insights from Spotify officials and leading financial experts.

Financial Performance and Growth

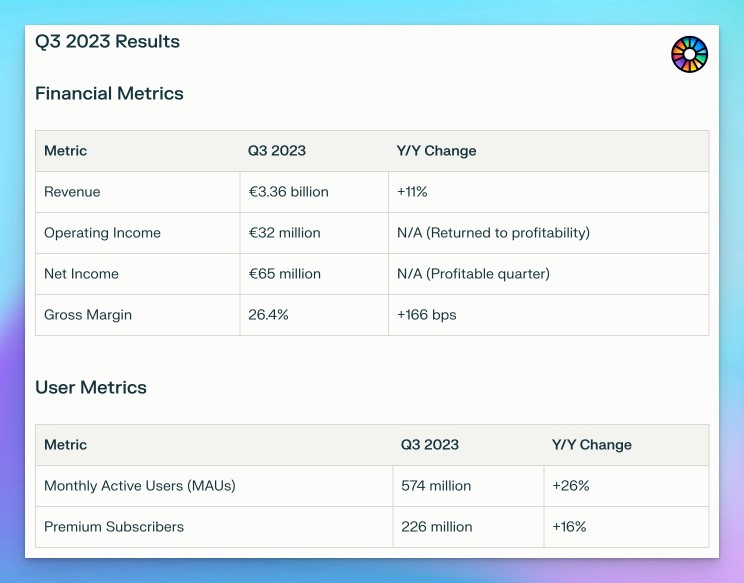

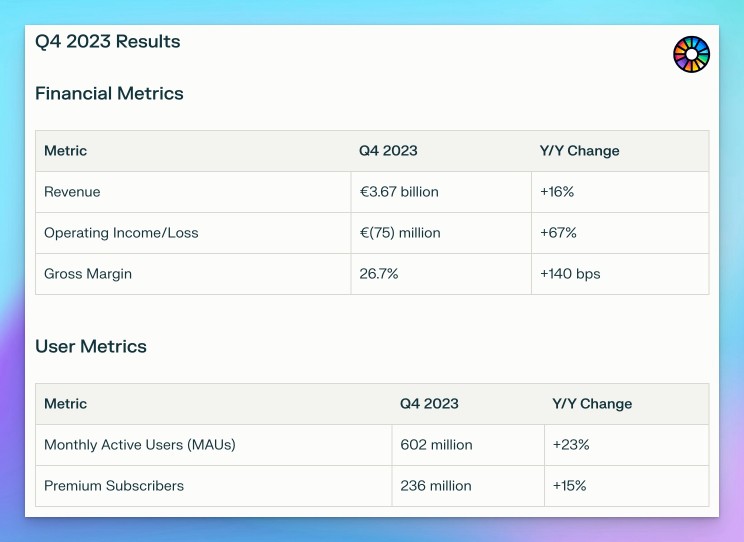

Spotify has experienced impressive growth in recent years, both in terms of its user base and revenue. According to the company's financial results, Spotify reported revenue of €13.2 billion in 2023, up from €11 billion in the previous year. This growth was driven by an increase in premium subscribers, which reached 236 million by the end of 2023, a 15% year-over-year increase.

Notably, promotions like Spotify Premium Free trials for 3 months have played a crucial role in attracting new users and converting them into loyal premium subscribers.

"Our Q4 results show that we are making great strides towards our goal of becoming a sustainable, profitable business," said Daniel Ek, Spotify's CEO, during the company's Q4 2023 earnings call. "We are seeing strong growth in both our premium subscriber base and advertising revenue, which is a testament to the value our platform provides to users and advertisers alike."

However, despite the impressive growth in users and revenue, Spotify has struggled to achieve consistent profitability. In the fourth quarter of 2023, the company reported a net loss of €70 million, although this was an improvement compared to the €430 million loss in the same quarter of the previous year. However, Spotify did report an operating profit of €32 million in the third quarter of 2023, marking its return to profitability after years of losses.

Cost Pressures and Efficiency Measures

One of the primary challenges facing Spotify is the high cost associated with licensing music from record labels and publishers. The company pays a significant portion of its revenue to rights holders, leaving a narrow margin for profitability.

"Spotify's business model is inherently challenging," said Mark Zgutowicz, an analyst at Rosenblatt Securities. "The company has to pay a significant portion of its revenue to music labels and publishers, which leaves little room for profitability."

To address this issue, Spotify has implemented several cost-cutting measures, including layoffs and restructuring efforts. In December 2023, Spotify announced that it would be slashing 17% of its global workforce, cutting approximately 1,500 jobs.

"We are taking these actions to rightsize our costs and ensure we are well-positioned for the future," said Daniel Ek in a memo to employees. "While these decisions are difficult, they are necessary to ensure the long-term success of our business."

Diversification and Innovation

To address the challenges of the music streaming market and reduce its reliance on a single revenue stream, Spotify has been actively pursuing diversification strategies. The company has invested heavily in podcasts and audiobooks, acquiring popular shows and platforms like The Joe Rogan Experience, Gimlet Media, and offering over 150,000 audiobooks for free to premium subscribers.

"Podcasting and audiobooks represent a significant growth opportunity for Spotify," said Daniel Ek during the company's Investor Day in 2022. "By expanding into these areas, we can create new revenue streams and attract a broader audience to our platform."

Spotify has also focused on product innovation and personalization, introducing features like AI DJ, games, and social integrations to attract younger demographics like Gen Z. With its Spotify Wrapped and new AI features, the company has leveraged its vast user data to improve its recommendation algorithms, playlists, and overall user experience, which has contributed to its strong user engagement and retention rates.

Competitive Landscape and Industry Challenges

Despite its dominant position in the music streaming market, Spotify faces intense competition from tech giants like Apple, Amazon, and Google, which offer their own music streaming services. These companies have deep pockets and can afford to subsidize their music offerings, making it challenging for Spotify to compete on pricing and features.

"Spotify is facing intense competition from deep-pocketed tech giants like Apple and Amazon," said Michael Pachter, an analyst at Wedbush Securities. "These companies can afford to subsidize their music streaming services, which puts pressure on Spotify's margins."

Additionally, the rise of alternative platforms like TikTok and YouTube has introduced new ways for users to discover and consume music, potentially threatening Spotify's dominance in the streaming market.

Furthermore, Spotify's relationship with the music industry has been complex, with record companies benefiting significantly from royalty payments while artists face challenges in earning substantial income from streaming. The streaming model has been criticized for its impact on smaller artists, despite being lucrative for well-known artists.

The Verdict: Unlikely to Go Out of Business, but Challenges Remain

Based on the analysis of Spotify's financial performance, growth metrics, and strategic initiatives, as well as insights from Spotify officials and leading financial experts, it is unlikely that the company will go out of business in the near future. Spotify's massive user base, brand recognition, and dominance in the music streaming market provide a solid foundation for its continued existence.

However, the company's long-term success will depend on its ability to navigate the intense competition, resolve licensing disputes, and find a sustainable path to consistent profitability. This may involve further diversification, renegotiating licensing agreements, exploring alternative revenue models, and continuing to innovate and enhance its product offerings.

"Spotify has a lot of work to do to achieve sustainable profitability," said Daniel Ek during the company's Q4 2023 earnings call. "But we are confident that our strategic initiatives, combined with our focus on cost discipline and operational efficiency, will put us on the right path."

Spotify's recent financial results and strategic initiatives, such as cost-cutting measures, pricing increases, and diversification into new content verticals like podcasts and audiobooks, suggest that the company is taking steps to address its challenges and improve its profitability. However, the road ahead remains challenging, and Spotify will need to continue adapting to the ever-changing landscape of the music industry and consumer preferences.

Ultimately, Spotify's future will hinge on its ability to leverage its strengths, such as its vast user data, innovative spirit, and market-leading position, while addressing its weaknesses and capitalizing on emerging opportunities in the audio entertainment space.

Sources

- https://investors.spotify.com/financials/default.aspx

- https://www.defenseworld.net/2024/03/17/exchange-traded-concepts-llc-purchases-2525-shares-of-spotify-technology-s-a-nysespot.html

- https://www.fool.com/investing/2023/05/26/3-reasons-for-long-term-investors-to-get-spotify/

- https://newsroom.spotify.com/2024-02-06/spotify-reports-fourth-quarter-2023-earnings/

- https://www.wired.com/story/spotify-layoffs-music-streaming-future/

- https://www.nasdaq.com/articles/spotify-stock-nyse:spot:-the-market-is-ignoring-a-major-risk

Spotify Pie

Spotify Pie